The $70 Million Habit: Inside the Explosive Financial Meltdowns That Left Hip-Hop’s Biggest Stars With $100 in the Bank

The image of a superstar rapper is one of untouchable wealth: gold-plated gates, fleets of exotic cars, private jets on standby, and diamonds that catch the spotlight. This is the aspirational vision sold to millions, a powerful testament to the financial rewards of making it in the music industry. But behind the platinum plaques and the Instagram flexes lies a brutal and often unseen reality: the trap of the gold chain.

A staggering number of hip-hop’s biggest names—artists who generated tens and even hundreds of millions of dollars—have experienced devastating financial collapses, leaving them in debt, bankruptcy, and, in some cases, with barely $100 to their name. These are not cautionary tales of bad luck; they are profound lessons in legendary financial self-destruction, driven by unsustainable lifestyles, unchecked addictions, predatory deals, and, most crucially, a catastrophic misunderstanding of tax law.

This is the story of ten careers that imploded, transforming generational wealth into mountains of debt and proving that in the rap game, the tax man is the one rival no one can defeat.

The Architect of Ruin: When the Flex Becomes a Financial Guillotine

The first sign of trouble for many stars is the inability to distinguish between income and wealth. To maintain the necessary image of success, they commit to expenses that are simply unsupportable, transforming their entire operation into a costly, appearance-driven Ponzi scheme.

No one personifies this tragedy more completely than MC Hammer (00:00:34). In the early 90s, the man was “stupid rich,” pulling in an estimated $30 million annually. He built a personal empire, centered on a mansion the size of a shopping center and a massive, loyal entourage. Hammer was reportedly paying over 200 people—barbers, chefs, distant cousins, and security—to maintain his world, spending over $500,000 per month just on upkeep and appearances (00:01:03). When record sales inevitably dipped and the touring checks slowed down, the lifestyle did not. By 1996, the entire structure came crashing down. He filed for bankruptcy, listing over $13 million in debt (00:01:22). Hammer’s legacy is now less about his iconic dance moves and more about a flashing red light for every aspiring artist: a warning that if you make $30 million and still go broke, the problem is not the money, but the discipline (00:01:56).

A similar, though less grand, form of self-sabotage plagued the younger generation. The infamous Bow Wow challenge of 2017 perfectly captured the absurdity of the broke flex (00:18:25). After the former child star posted an image of a private jet, claiming he was flying in style, he was instantly exposed by a fellow passenger for flying commercial coach (00:18:37). The meme that followed was funny, but the underlying reality was devastating: court documents from a 2012 child support case revealed Bow Wow had only $1,500 in his checking account, despite continuing to rent Rolls-Royces and shop like he was still on the Forbes list (00:18:50). He was, in effect, a poster child for what happens when image completely outpaces income.

The Silent Killer: The Inevitable Reckoning of the Tax Man

While overspending is voluntary, ignoring the government is a mandatory path to destruction. The vast majority of high-profile rap meltdowns involve the IRS, child support, or both. These debts, unlike private loans, are virtually impossible to shed, turning a financial setback into a full-blown federal case.

The tragedy of DMX is one of the most painful examples (00:06:21). The legendary rapper, who had five consecutive number one albums and sold over 74 million records, died broke in 2021. His estate was left in chaos, destroyed by addiction, chronic legal issues, and the constant, crushing weight of child support for his 15 children (00:07:02). In 2013, he filed for bankruptcy, owing between $1 million and $10 million (00:07:21). The situation escalated in 2017 when he was indicted for tax fraud, owing $1.7 million in unpaid taxes (00:07:42). DMX served a year in prison for it, his pain and chaos amplified by the cold, unyielding machinery of the government. He gave the world everything, but the business side gave him very little in return, leaving him with debt and lawsuits instead of a legacy of financial stability.

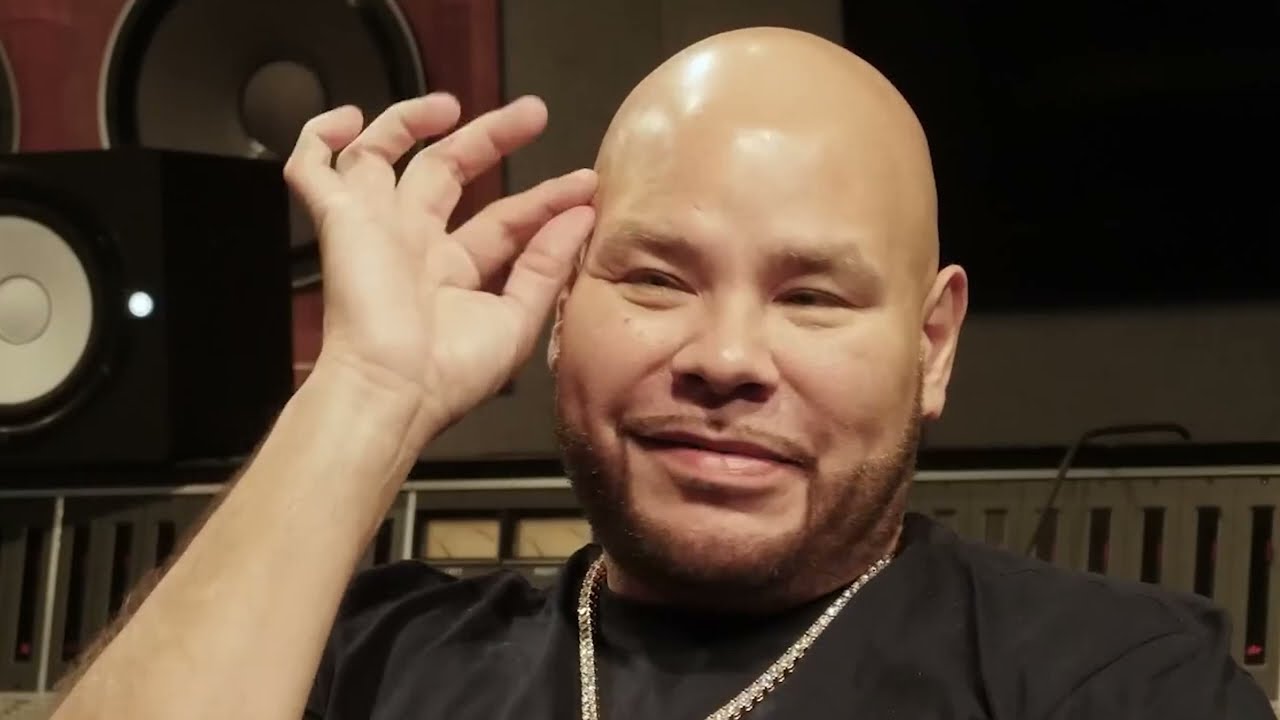

Even the most celebrated figures, like Fat Joe, were not immune (00:14:16). The Terror Squad boss, who appeared to epitomize wealth, pled guilty to tax evasion in 2012 for failing to file returns from 2007 to 2010. He owed over $700,000 to the IRS (00:14:54). Joe served four months in prison, a brutal fall from grace that proved his famous line was right: “When the IRS knocks, they don’t play” (00:15:35). Though he managed a comeback, he admitted the bill “wrecked his finances,” forcing him to sell assets and restructure his entire life, demonstrating that you can beat your rivals in the booth, but never the tax man.

Similarly, Beanie Sigel, the street poet of Roc-A-Fella, had his career and life derailed by the same mistake (00:10:23). In 2010, he was hit with tax evasion charges for owing over $728,000 and was sentenced to two years in federal prison (00:11:10). Upon his release, he was broke, struggling to afford a lawyer, and later suffered a shooting that led to the removal of a lung (00:11:54). His story shows how fast loyalty, fame, and opportunity fade when the cash dries up and the debt remains.

The Ultimate Self-Destruction: When Addiction Consumes $70 Million

Sometimes, the primary cause of financial ruin is a self-inflicted wound so catastrophic it defies business logic. The story of producer Scott Storch is the most explosive example of how quickly a fortune can vanish when personal demons take the wheel (00:08:29).

Storch was a titan, the man behind hits for Beyoncé, 50 Cent, and Justin Timberlake. At his peak, he was worth over $70 million (00:08:58). Yet, he managed to blow the entire fortune in less than three years. The core reason was a colossal cocaine addiction. Storch was reportedly dropping a staggering $250,000 a month on cocaine—an amount that rivals the GDP of a small nation—and pairing this with an equally absurd spending habit (00:09:05). He bought multiple mansions, a private jet “just to flex,” and indulged in a “champagne lifestyle for a loco budget,” spending so much on models and actresses that he claimed he built his own personal Maxim calendar (00:09:23). By 2009, the money was gone. Storch filed for bankruptcy, claiming he had a mere $3,600 in assets (00:09:37). His case is irrefutable proof that it’s not how much you make, but how much you keep, and that an unchecked habit can destroy decades of success in months.

The Financial Casualty: Bad Business, Beef, and the $100 Account

Beyond drugs and taxes, many rappers were simply victims of bad business decisions, ill-structured deals, or a failure to adapt to a changing industry. These financial struggles were often exposed in the most humiliating ways.

Young Buck’s downfall was a spectacle of G-Unit royalty hitting rock bottom (00:04:09). After his initial split with 50 Cent, the money dried up and the IRS demanded its due. The feds raided his house in 2010, taking jewelry, recording equipment, and even his furniture (00:04:46). Buck later filed for bankruptcy—twice. The most embarrassing moment was a leaked phone call with 50 Cent, where Buck was heard literally begging for help, trying to secure a loan and therapy in the same conversation (00:05:04). By his second filing in 2020, he claimed he only had about $100 in cash, a single vehicle, and monthly expenses he couldn’t pay (00:05:48).

Trick Daddy’s financial situation was even more dire. When he filed for bankruptcy in 2019, court documents revealed he had zero dollars in savings and just $100 in his checking account (00:02:29). His assets were listed as a 2004 SUV, a house, and a single pitbull (00:02:49). His debt was over $800,000, including $57,000 in back child support and $290,000 in unpaid taxes (00:02:54). Trick Daddy was a victim of bad business structure, legal issues, and poor money management, but earned a small measure of respect for his honesty, openly admitting, “I’m broke but I ain’t ashamed” (00:03:36).

Then there are the cases of the walking financial disaster, like Tyga (00:16:05). The “Rack City” rapper isn’t technically bankrupt, but his name is synonymous with debt and lawsuits. He has a habit of moving into luxury homes and refusing to pay rent, once owing one LA landlord over $124,000 (00:16:43). His fleet of Maybachs, Ferraris, and Rolls-Royces looked great on Instagram until the repo man showed up multiple times, snatching the cars back (00:17:03). Tyga’s story is a constant cycle of flexing broke, using expensive rentals and refusing to pay bills to maintain an image that is constantly being exposed in court records.

Finally, Lil Flip’s fall was marked not by a crash, but a slow, painful fade (00:12:19). The “freestyle king” was independent early on, which meant more income, but also meant he had to fund his massive entourage and career himself. Once his beef with T.I. nuked his momentum and his sales stopped, the bills didn’t. He kept dropping mixtapes no one was asking for, trying to keep his career on life support while getting caught up in lawsuits over show no-shows and allegedly pawning his own jewelry (00:13:24). For Flip, going broke meant vanishing quietly and painfully, a financial struggle in silence, forgotten by the industry that once celebrated him.

The Unforgiving Lesson: Image vs. Income

The cumulative story of these ten stars and their catastrophic meltdowns—from DMX’s $1.7 million tax fraud to Storch’s $70 million drug habit—paints a clear picture of the Hip-Hop Financial Trap (00:20:05). It’s a toxic cycle disguised as a lifestyle, where:

Fast Money is an Illusion:

-

- Large advances and massive checks are often tied to predatory contracts and carry huge, hidden tax liabilities.

The Entourage is a Drain: The need for “yes men” and an unnecessary crew quickly eats up profit and isolates the star from genuine financial advice.

Flexing is a Cost Center: Every rented car, every unpaid bill, and every show no-show eventually results in a lawsuit, eroding both the bank account and the personal brand.

The one universal takeaway, regardless of how much money they made, is that financial literacy and discipline are the only paths to generational wealth. Without a solid financial team—accountants, managers, and lawyers focused on long-term stability rather than short-term gains—the rapper is one platinum plaque away from joining the next list of stars who lost it all. The fame may last a lifetime, but without discipline, the money only lasts until the repo man knocks. The question for every new artist is not whether they will achieve success, but whether they will have the wisdom to preserve it.